Ballymaley, Gort Road, Ennis, Co. Clare, V95 T449

Ballymaley, Gort Road, Ennis, Co. Clare, V95 T449

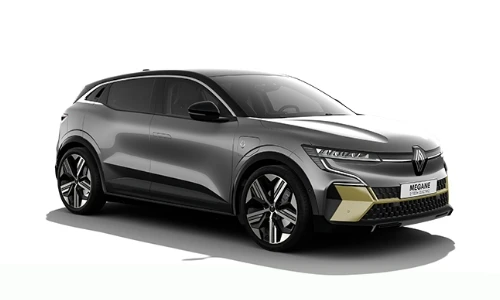

Which Renault model takes your fancy?

5 Year Warranty

MORE DETAILS

0% APR or €1,500 trade in bonus

5 Year Warranty

from: €36,995

MORE DETAILS

5 Year Warranty

from: €25,995

MORE DETAILS

0% APR or €1,500 trade in bonus

5 Year Warranty

from: €33,195

MORE DETAILS

0% APR or €1,500 trade in bonus

5 Year Warranty

from: €45,295

MORE DETAILS

0% APR or €1,500 trade in bonus

5 Year Warranty

from: €32,890

MORE DETAILS

0% APR or €1,000 trade in bonus

5 Year Warranty

from: €30,545

MORE DETAILS

0% APR or €1,500 trade in bonus

5 Year Warranty

from: €29,120

MORE DETAILS

5 Year Warranty

from: €64,900

MORE DETAILS

0% APR or €1,500 trade in bonus

5 Year Warranty

from: €51,495

MORE DETAILS

0% APR or €1,500 trade in bonus

5 Year Warranty

from: €39,995

MORE DETAILS

At HOGAN MOTORS we stock the complete range of new Renault cars at our modern showroom in Ennis. Our range of Renault cars include the award winning Renault Clio, the stylish Renault Megane, the ever popular Renault Captur, and the Renault Symbioz family car. We also stock a range of affordable Renault Electric Cars that includes the Renault 5 E-Tech, the Megane E-Tech, and the Renault Scenic E-Tech. For more information on your preffered model, please select your preferred Renault below or contact us now for more information.